The Importance of Financial Knowledge: Beyond Earning Money

Welcome Back to the Blog!

Before diving into the how, let’s first explore the why.

We often hear that happiness comes from earning more money, but the truth is, financial knowledge reveals that financial success is about much more than just boosting your income. To truly thrive financially, it’s essential to understand not just how to acquire wealth, but also how to manage and grow it wisely. In this journey, financial knowledge is your most powerful tool. Together, we’ll explore why mastering these concepts can make all the difference in achieving your financial goals and securing a brighter future.

The Reality of Financial Knowledge Mismanagement

You might have noticed how some celebrities and high-profile individuals accumulate significant wealth, only to face financial ruin later. This underscores a vital point: possessing wealth is not enough; managing it wisely is essential. History is replete with examples of people who, despite their wealth, ended up bankrupt due to poor financial management.

Take, for instance, the story of Mike Tyson, one of the most famous boxers in history. At the peak of his career, Tyson earned over $300 million. However, his inability to manage his finances, coupled with extravagant spending and legal troubles, led him to file for bankruptcy in 2003. Despite his enormous earnings, Tyson’s story highlights how essential financial management is, regardless of how much money one initially accumulates.

Another example is Evander Holyfield, another boxing champion who earned over $500 million throughout his career. Holyfield’s financial woes included lavish spending on multiple homes, cars, and a large staff, which, combined with poor investment decisions and legal battles, led him to bankruptcy. His experience illustrates how even significant wealth can quickly erode without careful management and planning.

Similarly, Nicolas Cage, the renowned actor known for his roles in blockbuster films, amassed a fortune estimated at over $150 million. However, his penchant for buying numerous properties, including castles and rare artifacts, coupled with poor financial advice, led him to financial difficulties and tax issues. Cage’s experience serves as a reminder that even substantial earnings can be mismanaged, leading to significant financial distress.

These examples underscore a crucial lesson: managing your finances effectively is as important as earning money. Without proper financial strategies, budgeting, and investments, even the wealthiest individuals can find themselves facing financial instability. This highlights the importance of financial education and strategic planning to ensure that your wealth is not just acquired, but also preserved and grown wisely.

The Balance Between Earning and Spending

J.K. Rowling, the author of the Harry Potter series, provides a contrasting example of financial management. After achieving immense success and wealth from her books, Rowling initially faced significant financial struggles due to her overspending on an extravagant lifestyle. However, she later adopted a more balanced approach, focusing on prudent investments and charitable giving, which helped her maintain and grow her wealth responsibly.

Similarly, many individuals with modest incomes might fall into the habit of underspending, either out of fear or a desire to save excessively. For instance, Tina, a fictional character, might diligently save and invest every penny she earns, avoiding any form of leisure or discretionary spending. While this might seem prudent, excessive frugality can lead to a lack of enjoyment in life and missed opportunities for personal and professional growth.

Why Do We Save?

A common question arises: Why do people save so much money if they don’t seem to have a clear plan for spending or passing it on? According to a survey, several reasons drive people to save:

- Unforeseen Costs: 40% worry about unexpected expenses.

- Legacy: Many see savings as a way to leave a financial legacy.

- Emotional Comfort: Savings provide peace of mind.

- Fear of Running Out: Some fear depleting their funds if they start spending.

- Preservation: Around 20% prefer to conserve their money because once spent, it’s gone.

These reasons prompt an intriguing question: Why work so hard to earn money if you don’t plan to use it? What if there’s a way to save effectively without being overly frugal?

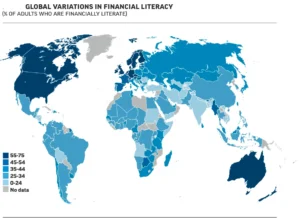

The Global Financial Literacy Challenge

Financial literacy is a pressing global issue. Despite high education levels, financial education often falls short. Many people struggle with basic concepts like saving, investing, debt management, and budgeting.

Consider the case of Greece during the financial crisis of the late 2000s. Despite having a highly educated population, many Greeks faced severe financial hardship due to a lack of understanding about personal finance and debt management. The crisis highlighted how even well-educated individuals can be unprepared for financial challenges if they lack practical financial knowledge.

In the United States, financial literacy is also a significant concern. For example, a 2023 survey by the National Endowment for Financial Education revealed that nearly 60% of American adults struggle with basic financial concepts like compound interest and credit scores. Despite having access to higher education, many still find themselves in debt due to a lack of understanding of how to manage credit or plan for retirement. This gap in financial education contributes to widespread issues such as high credit card debt and insufficient retirement savings.

Globally, the situation is similarly troubling. In India, a country with a rapidly growing economy, many individuals still face challenges with financial literacy. A 2022 report by the Reserve Bank of India showed that a significant portion of the population lacks basic financial knowledge about financial products and services. For instance, many people are unaware of how to manage personal loans or invest in financial markets, which affects their ability to make informed financial decisions and secure their financial futures.

The State of Financial Literacy Around the World

Financial literacy varies widely across the globe:

- United States: Many households are burdened with credit card debt, and many have not saved for retirement.

- China, Russia, Brazil, South Africa: Financial literacy rates in these countries are similarly low.

- Developed Countries: Even in wealthier nations, financial literacy issues persist, indicating a widespread problem.

Many people turn to friends and family for financial knowledge advice but often lack access to professional guidance. Addressing the basics of financial education is crucial.

Bridging the Gap: Practical Financial Education

The key to improving financial literacy lies in education. Schools should not only teach theoretical concepts but also practical financial knowledge decision-making. Understanding how to budget, calculate expenses, set realistic savings goals, and track progress is essential for financial health.

The Impact of Financial Literacy

Recent surveys highlight that many individuals, especially millennials, struggle with financial literacy:

- 72% are unsure about how much to save or invest for financial independence.

- 76% believe there is a need for more financial planning education.

- 51% of millennials feel a lack of personal finance knowledge is hindering their financial progress.

Financial literacy helps individuals make informed decisions, maintain a healthy credit score, and improve their standard of living. For instance, you might need at least one million dollars to retire comfortably and live without working for 30 years. Financial literacy provides the tools to make smart investments without unnecessary frugality.

The Path to Prosperity

Ultimately, financial literacy is key to leading a well-balanced and prosperous life. Understanding and applying sound financial principles empowers you to achieve your financial goals and secure a more fulfilling future.

That’s where Saving Cedar comes in. Drawing from my own personal experiences with managing finances, I’m here to help you navigate the complexities of personal finance knowledge with confidence. Having faced and overcome various financial challenges myself, I understand the importance of having the right tools and knowledge at your disposal.

1 thought on “Why Balanced financial knowledge is important?”