In this blog, we’re going to delve into the 3 essential pillars of financial planning: earning, spending, and saving. In our previous article, we explored the importance of financial knowledge and its impact on achieving financial stability. While these concepts might seem basic or even elementary, understanding how to effectively balance and integrate them can lead to remarkable results. You might think you already know about these pillars, but discover how their harmonious interplay can create a powerful strategy for transforming your financial future.

3 Essential pillars of financial planning equation: Earning – Expenditure = Saving

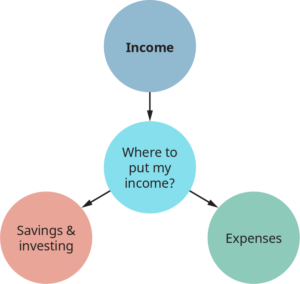

At its core, financial health is about ensuring that your income (earning) exceeds your expenses (expenditure) so that you can set aside money for savings. Here’s how each component plays a crucial role but before that lets dive into a related personal perspective.

A Personal Perspective: The Reality of Living Fully

I know personally many individuals who earn a decent income but spend almost every penny they make, leaving little to no room for savings. Their common refrain is that they want to live life to the fullest, enjoying every moment without being bogged down by financial concerns. While their intention is admirable, the reality is that this approach often leads to financial stress and missed opportunities for future stability.

Take, for example, a friend of mine who earns a comfortable salary but chooses to spend extravagantly on dining out, vacations, and the latest gadgets. Despite the thrill of these experiences, they often find themselves stressed about unexpected expenses and lacking a financial safety net. When emergencies arise, or when it’s time to plan for long-term goals, they face significant challenges due to the lack of savings.

Living life to the fullest doesn’t have to mean spending every dollar you earn. Imagine if my friend had saved just a small portion of their income each month. They could have built an emergency fund, invested in opportunities, or even taken time off work to enjoy life without financial worries. Balancing 3 essential pillars of financial planning i.e earning, spending, and saving can allow you to savor life’s pleasures now while also preparing for a secure and fulfilling future.

Earning: Maximizing Your Income

Earning refers to the money you bring in through your job or business what you do. To create a strong financial foundation, it’s important to focus on increasing your earning potential. This could mean seeking career advancement, pursuing additional education or certifications, or exploring new income streams.

Example: Imagine you have a job that pays $50,000 annually. By acquiring a new skill or certification, you might be able to negotiate a salary increase to $60,000. This additional income provides more room to save and invest.

Expenditure: Managing Your Spending

Expenditure encompasses all your regular and discretionary expenses, including rent, utilities, groceries, and entertainment. Effective financial planning requires you to manage your spending wisely to ensure it doesn’t exceed your income.

Example: Suppose your monthly income is $5,000, and your expenses total $4,000. By tracking your spending and identifying areas where you can cut back, such as dining out or subscription services, you can reduce your expenditures to $3,500. This adjustment increases your savings potential.

Saving: Building Your Financial Cushion

Saving is the portion of your income that you set aside after covering your expenses. This money can be used for emergencies, future investments, or achieving financial goals. Effective saving involves not only putting money aside but also making your savings work for you through investments.

Example: With a balanced budget where your earnings are $5,000, your expenditures are $3,500, and you save $1,500 each month. Over a year, this amounts to $18,000 in savings. If you invest this amount wisely, it can grow significantly through interest and returns.

The Earning – Saving = Expenses Formula

When it comes to managing your finances effectively, the new formula Earning – Saving = Expenses can be a game-changer, especially for single individuals and those without dependents. This approach emphasizes the importance of saving before determining your expenditure, helping you build a solid financial foundation while still enjoying your lifestyle.

At its core, this 3 essential Pillars of Financial Planning formula underscores the principle that saving should be a priority, not an afterthought. By allocating a portion of your income to savings first, you define how much you can comfortably spend. This method ensures you are prepared for the future while managing your current expenses wisely.

Finding Balance: The Key to Financial Success

While the Earning – Saving = Expenses formula is highly effective, it’s important to remember that financial management is about balance of 3 essential Pillars of Financial Planning. For those with family or dependents, certain expenses are unavoidable and should not be compromised in the pursuit of saving more. It’s crucial to find a balance between saving and spending that fits your unique circumstances.

Example: If you have dependents, your budget might include essential expenses such as childcare, education, and medical costs. In such cases, saving might be a smaller percentage of your income, but the principle remains the same—allocate a portion of your income to savings first and manage your spending within the remaining amount.

I hope it helped you to give a different perspective. Do share your comments and stay tuned for more exciting content.